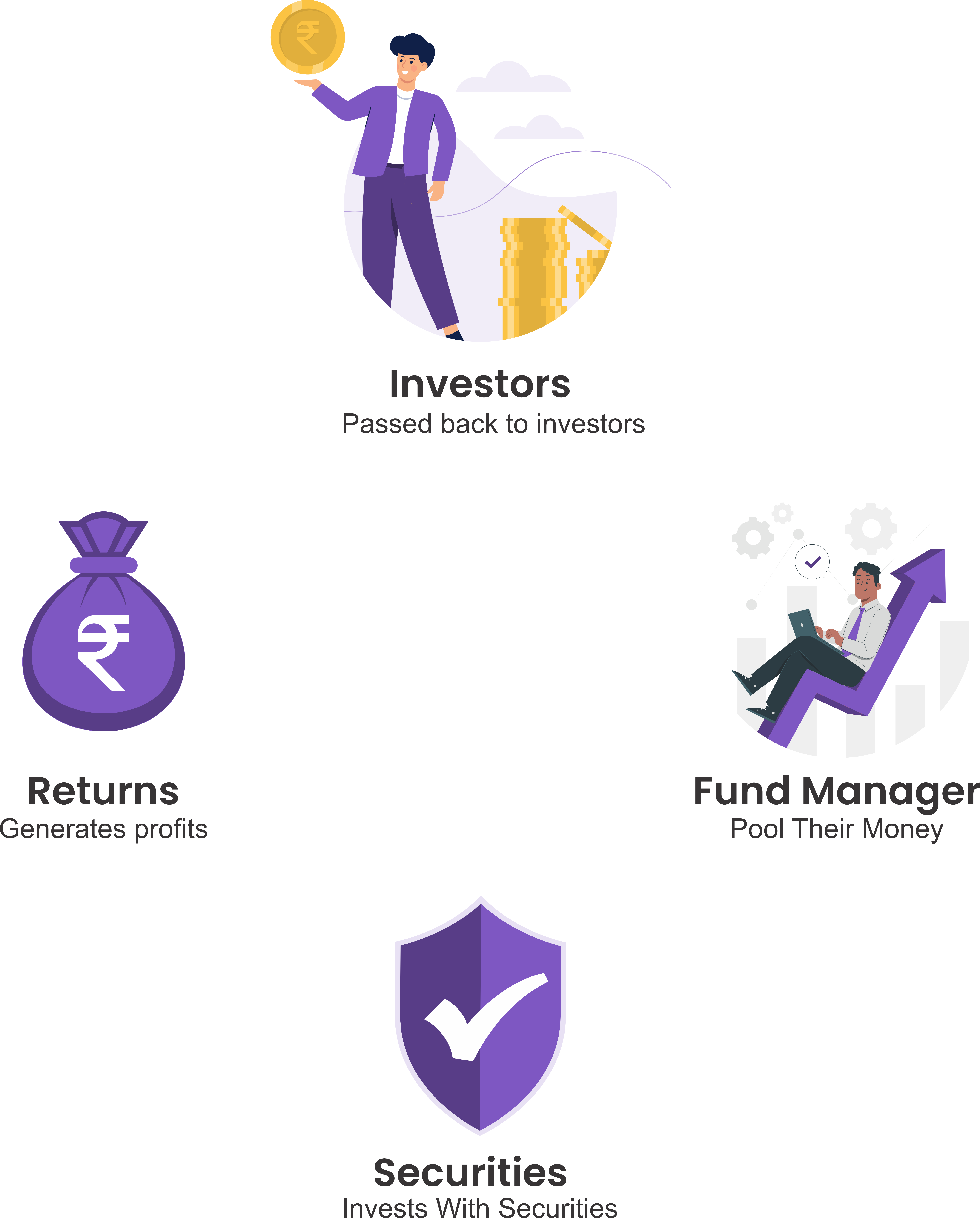

What are Mutual Funds?

Mutual funds are investment vehicles that pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other securities. A professional fund manager manages the portfolio, aiming to generate returns for the investors. Mutual funds offer diversification and are accessible to small investors, allowing them to invest in a variety of assets with minimal effort.

Why Mutual Funds?

Professionally Managed

One of the key benefits of investing in these funds is that your money is managed by professional money managers who have years of investing experience.

Liquidity

It is the ease of buying and selling an investment. Mutual Funds offer superior liquidity compared to some of the other instruments as you can buy and sell them anytime you want.

Returns

Like any investment product, the performance of these funds are measured in terms of the kind of returns they deliver. Historically, Equity mutual fund returns have been higher than the returns delivered by other traditional investment options like Bank FDs, RDs, PPF, etc.

Affordability

You can start your investments in these funds with as low as ₹ 100. Therefore, you don’t need large sums to start investing.

Diversification

As mutual funds invest in a basket of stocks, bonds, etc. you can own a diversified portfolio even with a small investment amount, this helps reduce risk as well.

Well Regulated

Mutual fund schemes are regulated by the SEBI. The tight regulations ensure transparent processes and protect the investors’ interests.

Types of Mutual Funds

Large Cap Mutual Funds

Invest smartly and aim high with Large Cap Mutual Funds, your path to consistent returns and financial success. These funds invest at least 80% of their assets in top 100 companies of by market cap.

Mid Cap Mutual Funds

Smart Investments in Growing Companies. These funds put your money in medium-sized businesses with Multi Cap Funds big potential.

Small Cap Mutual Funds

Small Cap funds invest in the smallest companies in India. Most of these companies are unknown to us on a daily basis and are not among the top 250 corporations. Small Cap firms can yield excellent profits, but they are very volatile and can result in short- to medium-term losses.

Flexi Cap Mutual Funds

These funds spread your investment across large, mid, and small-cap companies, with the mix decided by expert fund managers for flexibility and broad diversification.

Large & Mid Cap Mutual Funds

These funds combine investments in solid, well-established large-cap companies with the dynamic potential of mid-cap firms, aiming to provide a stable yet growth-oriented portfolio for long-term investment objectives.

Multi-Cap Mutual Funds

These funds invest across various market sizes, from established giants to emerging players, aiming to offer a mix of security and growth potential for long-term investment success.

Focused Mutual Funds

These funds concentrate on a select few high-conviction stocks, allowing investors to benefit from a deeply researched, focused approach to stock selection.

Dividend Yield Mutual Funds

Dividend yield funds are a type of equity mutual fund that invests in companies with a history of paying high dividends. These funds are designed to generate income for investors by investing in stocks that pay out a regular portion of their profits.

Value Oriented Mutual Funds

Value funds are equity mutual funds where the fund manager looks for stocks that are currently trading on discount due to some reason but have a lot of potential to grow.

Sectoral-Technology Mutual Funds

Sectoral Technology Funds are equity mutual funds which invest a minimum of 80% of the total investment in sectors related to technology and communication.

Sectoral-Infrastructure Mutual Funds

Sectoral - Infrastructure funds are equity funds that invest a minimum of 80% of total investment amount in sectors related to construction, metal & mining, basic materials and finance.

Sectoral-Banking Mutual Funds

Sectoral - banking funds are equity funds that invest a minimum of 80% of funds in sectors related to finance, banking and insurance.

Thematic-Consumption Mutual Funds

Thematic funds are equity mutual funds that invest in stocks tied to a theme. Thematic - Consumption Funds enables you to invest in sectors related to consumer goods like automobile, communication etc.

Thematic-Energy Mutual Funds

Thematic funds are equity mutual funds that invest in stocks tied to a theme. Thematic - Energy Funds enables you to invest in sectors related to energy and capital goods.

FMCG Mutual Funds

FMCG funds invest in companies within the Fast-Moving Consumer Goods sector, such as food, beverages, and personal care products. These funds offer stable returns due to the consistent demand for consumer goods.

Sectoral Mutual Funds

Sectoral funds invest in companies operating within a specific sector like technology, healthcare, or finance. They offer high potential returns but come with higher risk due to concentration in a single sector.

Thematic Mutual Funds

Thematic funds invest based on a specific theme or trend, such as infrastructure, digital innovation, or clean energy. These funds can be diversified across sectors but are aligned with a particular investment theme.

ESG Mutual Funds

ESG funds prioritize investments in companies that meet Environmental, Social, and Governance criteria. They appeal to investors who want to support sustainable and ethical business practices while seeking financial returns.

Liquid Mutual Funds

These funds invest in low-risk, easily accessible money market instruments, providing a safe option for parking your short-term cash. They offer modest returns, capital preservation, hassle-free access with no lock-in, entry/exit loads, minimal risk, and the convenience of one-day withdrawals.

Low Duration Mutual Funds

Secure Short-Term Investments for Steady Returns. By focusing on fixed-income securities that mature quickly, they provide a stable income with low exposure to interest rate risks, thereby minimizing the potential for capital loss due to market shifts.

Short Duration Mutual Funds

These funds invest in a variety of securities with brief maturity periods, offering investors a blend of modest returns and reduced risk, ideal for meeting financial needs in the short-term horizon.

Corporate Mutual Funds

These funds focus on investing in company-issued debt, offering a steady income with moderate risk. This makes them a good choice for investors looking for a safer, fixed-income investment.

Dynamic Bond Mutual Funds

Dynamic bond funds are debt funds designed to flexibly adjust their lending durations. They enable fund managers to capitalize on interest rate fluctuations, aiming for enhanced returns by extending or shortening lending durations based on the direction of interest rate movements in the economy.

Money Market Mutual Funds

Money Market Mutual Funds are low-risk investments that focus on short-term, high-quality debt like government bonds or treasury bills. They offer investors a safe place to park their money with easy access and stable returns.

Bank & PSU Mutual Funds

These Funds are primarily in debt instruments issued by banks and public sector undertakings (PSUs). These funds offer a blend of safety and steady returns, making them suitable for conservative investors seeking reliable income.

Gilt Mutual Funds

Gilt funds are a type of debt mutual fund that invests primarily in government securities, also known as G-Secs, issued by the central and state governments of India.

Overnight Mutual Funds

Overnight funds are a type of debt mutual fund that invests in super short-term, highly secure securities with a maturity of just one day. The fund manager buys these super short-term debt instruments each day and lets them mature the next day, offering you a small return while keeping your money very liquid and accessible.

Gilt with 10 year Constant Duration Mutual Funds

Gilt funds with 10-year constant duration are a type of government bond mutual fund designed for stability. They invest in a mix of government securities that averages out to a 10-year maturity, making them less risky from interest rate changes than regular gilt funds.

Credit Risk Mutual Funds

Credit risk mutual funds are a type of fixed-income mutual fund that primarily invests in debt securities with a higher credit risk, such as high-yield bonds (also known as junk bonds) or low-rated corporate bonds.

Floater Mutual Funds

Floater mutual funds are a type of debt mutual fund that invests 65% of there holdings in bonds and securities whose interest rates changes according to market conditions and linked to a benchmark indices.

Long Duration Mutual Funds

Long Duration funds are a type of debt fund that extends loans to reputable companies for durations of 5 years or longer. Since these funds invest in long-term loans, their returns are sensitive to ups and downs in interest rates. This is because the borrowing companies' interest rates can change based on the overall economic climate.

Medium Duration Mutual Funds

Medium duration funds are debt funds that extend loans to reputable companies for periods of 3 years or longer. Since these funds invest in medium-term loans, their returns are sensitive to ups and downs in interest rates. This is because the borrowing companies' interest rates can change based on the overall economic climate.

Medium to Long Duration Mutual Funds

These are debt funds that lend to corporates for a duration of 4-7 years.

Ultra Short Duration Mutual Funds

Ultra Short Duration Funds are a type of debt fund that extends loans to companies for 3 to 6 months. Despite their short lending duration, they carry slightly more risk than liquid funds but are still among the safest options for investment within the categories.

Conservative Hybrid Mutual Funds

Conservative hybrid funds provide a low-risk investment option by combining a mix of debt instruments like corporate and government bonds and equity instruments like stocks, making them a suitable choice for risk-averse investors seeking stable returns with a balanced portfolio.

Aggressive Hybrid Mutual Funds

Aggressive Mutual Funds are high-risk investment options that aim to generate very higher returns by investing in stocks with strong growth potential but higher risk, suitable for investors with a higher risk appetite and a long-term investment horizon.

Arbitrage Mutual Funds

Arbitrage Funds invest in a combination of equity and debt instruments to take advantage of price differences between cash and derivative markets, potentially providing investors with low-risk, short-term returns that are largely independent of the stock market's direction.

Equity Savings Mutual Funds

Equity Savings Mutual Funds blend stock market investments, fixed-income securities, and arbitrage strategies. They target moderate growth by investing in equities, while bonds and arbitrage provide stability and risk mitigation. Ideal for investors seeking a balance of growth potential and reduced risk exposure.

Balanced Mutual Funds

Balanced Mutual Funds invest in a mix of stocks and bonds to balance risk and return. They offer a combination of growth (through equities) and stability (via bonds). These funds are suitable for investors looking for a moderate risk profile and diversified portfolio.

Multi Asset Allocation Mutual Funds

Multi asset funds offer investors a diversified investment option by investing in a mix of stocks, bonds, and other assets, potentially reducing risk and increasing returns by balancing different asset classes and market conditions.

Fund of Funds Mutual Funds

A Fund of Funds (FOF) is a mutual fund category that primarily invests in other mutual funds or similar investment instruments, rather than directly in individual securities such as stocks or bonds. The primary aim of a Fund of Funds is to offer investors diversification across different mutual funds or asset categories.

Retirement Mutual Funds

Retirement funds are a type of hybrid mutual fund that invests in both stocks and fixed deposit-like instruments. These funds are specifically designed to meet retirement goals and typically have a lock-in period of at least 5 years or until the investor reaches retirement age, whichever comes first.

Childrens Mutual Funds

A children's fund is a specialized mutual fund designed for specific child-related goals, like education costs. They often require a minimum 5-year lock-in or until the child reaches adulthood, whichever is earlier.

Ways to Invest in Mutual Funds

Systematic Investment Plan

SIP (Systematic Investment Plan) allows you to invest a fixed sum at regular intervals. SIP is one of the most recommended ways to invest in mutual fund schemes as it is convenient. It also helps you average out the cost at which you buy the units of these funds.

Lumpsum

When you make a one-time investment, it is called lumpsum. Lumpsum investments are generally done when people have got a big sum of money like bonuses or payments from a sale of an asset.